At LegalShield, we support entrepreneurs every day, but we’re particularly excited about Small Business Week 2023 from April 30 – May 6. Small business owners and communities across the country are invited to participate in National Small Business Week and support the millions of small businesses that create jobs, spur innovation and help drive economic growth nationwide.

Small business owners from across the country are invited to a 2-day Virtual Summit (May 2-3), led by the U.S. Small Business Association (SBA) and co-hosted by SCORE, mentors to America’s small businesses. This year’s event will include expert educational presentations, an exhibit hall, networking, and a mentoring lounge where you can get your questions answered.

The event is free to attend for both established and aspiring business owners. Register here. If you’re a small business owner or plan to launch your own business, LegalShield has plans to cover a variety of legal needs, advise you on important business decisions, and guide you to a wide range of essential resources that you may not know about!

Here are a few helpful insights about the SBA and Small Business Week 2023 to help your business year-round.

Small Business Loans

Small business owners usually need capital at some point to grow their business, start a new one, or simply stay afloat. However, banks and private equity investors are not always eager to lend. This is why the SBA helps small businesses get funding by setting guidelines for loans and reducing lender risk. Learn more and get started finding the loan that best suits your need.

Small Business Grants

The SBA also awards targeted grants that serve the greater good. These are limited, but you could qualify for help with:

- Small business grants that help small businesses engage in scientific research and development and provide management and technical assistance.

- Grants for community organizations, including those that support veteran-owned and service-disabled veteran-owned businesses.

Investment Capital

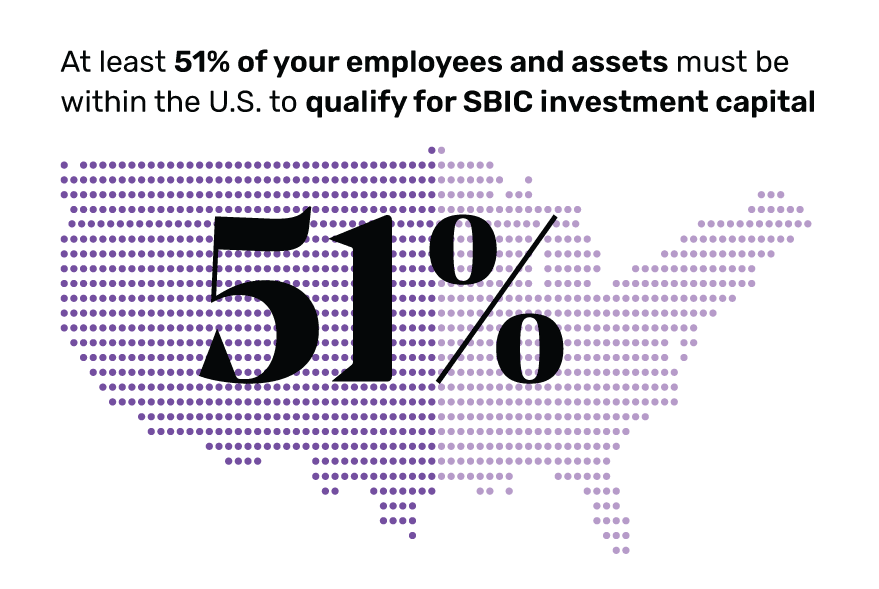

The quest for investment capital can be challenging, especially when you also have a business to run. The SBA helps small businesses access venture capital with its Small Business Investment Company (SBIC) program. To be eligible for an SBIC investment, you must meet the following requirements:

- At least 51% of your employees and assets must be within the United States.

- Qualify as a small business by SBA size standards.

- Qualify as an approved industry.

Check out the SBIC Directory online to help you find the investor that’s right for you.

Getting Government Contracts

To fund business ventures, you must first have business opportunities. The largest customer in the world is the U.S. government, which wants to buy products and services from entrepreneurs like you. The SBA awards 23% of prime government contract dollars to eligible small businesses. To get started, learn if your business meets the basic requirements.

Helping Socially Disadvantaged Small Businesses

Our economy is strengthened by diversity. 10% of all federal contract dollars go to socially disadvantaged small businesses owned by African Americans, Asian Americans, Pacific Islander Americans, Hispanic Americans, Native Americans and Subcontinent Asian Americans. You can register your business as a Small Disadvantaged Business if you meet the following criteria:

- The firm must be 51% or more owned and controlled by one or more disadvantaged persons.

- The firm must be small, according to SBA size standards.

Find the full qualification criteria in the Small Disadvantaged Business (SDB) Code issued by the SBA.

Small Business Legal Assistance

If running your business isn’t enough to think about, there are also critical legal considerations. LegalShield is a great resource, providing truly affordable legal help when you need it. We are your advocate. But don’t take our word for it, we were ranked 2022’s No. 1 Online Legal Service by Investopedia. A LegalShield plan frees our Small Business Members to focus on building their companies while we handle all the legal issues that come with being in business. You might run your own business, but you’re not on your own. Spend your time exploring resources like these for Small Business Week 2023. Let us deal with:

- Debt collection: Have a knowledgeable collections lawyer assist with debt collection and represent you, if necessary, in small claims court.

- Document review: Your LegalShield provider lawyer will review all your contracts and agreements, so you know they’re done right.

- Employment law: An experienced employment lawyer will help you with Workers’ Comp, hiring and firing, and ADA Compliance.

- Business licenses: Your provider lawyer will identify and secure all the federal and state business licenses you need.

- Intellectual property: Let an IP lawyer handle trademarks and copyrights.

- Civil litigation: Your provider law firm represents you in court for labor lawsuits, intellectual property infringement, employment litigation, breach of contract, bankruptcy, and dissolution.

- Plus, support other local businesses with your membership—your provider law firm is local to your community.

LegalShield offers different plans to fit your current needs and grow with you. As we said earlier, we celebrate entrepreneurs every week—by freeing them to focus on their dreams.

Frequently Asked Questions

When is Small Business Week?

National Small Business Week will be held from April 30 – May 6, 2023.

Where is the Small Business Week celebration held?

The central event is the SBA’s Virtual Summit, which hosts networking events, awards ceremonies, and seminars—but the 2023 National Small Business Week is really celebrated wherever small businesses are, as they bring wealth and job creation to their local communities.

Are the Virtual Summit dates the same as the Small Business Week 2023 dates?

No. The Virtual Summit runs May 2-3. Visit here to register. The 2023 National Small Business Week runs April 30 – May 6.

What is the SBA?

SBA.gov is the U.S. Small Business Administration, which was formed in 1953 to protect the interests of the small business owner. The SBA began National Small Business Week in 1963 to celebrate the American entrepreneur and highlight SBA resources.

What is SCORE?

SCORE, the nation’s largest network of volunteer, expert business mentors, is dedicated to helping small businesses get off the ground, grow and achieve their goals. Since 1964, SCORE has provided education and mentorship to more than 11 million entrepreneurs. SCORE is a 501(c)(3) nonprofit organization and a resource partner of the U.S. Small Business Administration (SBA). Pre-Paid Legal Services, Inc. (“PPLSI”) provides access to legal services offered by a network of provider law firms to PPLSI members through membership-based participation. Neither PPLSI nor its officers, employees or sales associates directly or indirectly provide legal services, representation, or advice. The information available in this blog is meant to provide general information and is not intended to provide legal advice, render an opinion, or provide any specific recommendations. The blog post is not a substitute for competent legal counsel from a licensed professional lawyer in the state or province where your legal issues exist, and the reader is strongly encouraged to seek legal counsel for your specific legal matter. Information contained in the blog may be provided by authors who could be a third-party paid contributor. All information by authors is accepted in good faith, however, PPLSI makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of such information.