+1-800-654-7757

Mon-Fri, 7am – 7pm CT

There are situations where settling a business debt for less than the original amount owed makes sense for both parties. Working with a collection lawyer can help.

The first step in determining whether you should offer a lower payment to settle a business debt is to identify which type of debtor you’re dealing with. There are different categories of debtors that may apply, as follows:

Your settlement strategy may change for each debtor as well as other factors such as the nature of the relationship and the amount of the debt owed. Join LegalShield and a small business debt provider lawyer can guide you through the settlement process with advice on the best course of action.

If you decide that settling for less than owed is a good option, you need to think about the amount you would be willing to accept as well as whether the repayment will come as a lump sum or through a payment plan. There are several factors that you can weigh.

Every financial situation is different and it’s wise to consult with a lawyer experienced in debt settlement. With a LegalShield membership, you can have your provider lawyer help you draft the appropriate debt settlement paperwork once you’ve come to an agreement.

Running your own business often requires taking on loans to finance your growth or expansion. In turn, being responsible for your company’s financial situation means understanding the types of loans available and understanding the terms of repayment—and what you can do if you can’t repay them according to the agreement.

Based upon your needs and your credit, there are several different types of business loans or financing you can seek, including (but not limited to) term loans, SBA loans, a business line of credit, and business credit cards. Depending upon the type of loan and the institution, these loans can be secured by collateral or unsecured, but either way, the lender expects repayment based upon the agreed-upon terms and schedule.

If you’re struggling to repay a business loan, a debt collection lawyer can help you in dealing with lenders or debt collection agencies. In addition to negotiating with creditors and agencies for debt relief, either by a reduced loan principle or an extended timeframe for repayment, a lawyer can prevent threatening or harassing behavior from debt collection agencies.

If you’ve already been sued by a creditor over your unpaid debt, a small business debt provider lawyer can represent you and present any defense or counterclaim you may have against the other party.

If you’re looking for outside help to collect outstanding debt, you have a choice between debt collection agencies and debt collection lawyers.

While both are capable of achieving your aims, there are drawbacks to working with an agency over a lawyer. As part of the terms of your agreement, you may be paying a hefty portion of the outstanding principal to the agency, leaving you with less to show for the trouble. And given that agencies have considerable incentive to collect that debt, and as much of it as possible, some less-than-scrupulous ones may engage in behavior that constitutes harassment under the laws protecting debtors, which may tarnish your reputation by association.

With a debt collection lawyer, you can be sure that your company’s representative is working within the law and within your directives for how you want to approach the situation. That means your lawyer can handle the phone calls and letters you would otherwise have to do yourself, and can work to negotiate a lump sum or monthly payments or other repayment plan with a debtor to avoid missing out on repayment entirely or having to take the case to court.

Keeping a cool head when you’re in the middle of a dispute over money is not easy. That said, remaining calm and being reasonable can help you during the process.

Whether your business is owed money or another entity is claiming you owe them money, having a lawyer handle the settlement negotiations can not only lead to a positive outcome, it can reduce your stress.

Join LegalShield today and, if appropriate, your provider lawyer can write a letter or make a phone call on your behalf to seek to settle the situation for you at no additional cost.

LegalShield’s business plans can help you in the following areas:

Legal consultation from a provider lawyer on business legal matters, with legal research for each issue, if needed.

Receive help with business legal matters more efficiently with professional communications issued on your behalf.

Put business-related legal document through legal review.

A collection letter from a provider lawyer could help you recoup payments more efficiently.

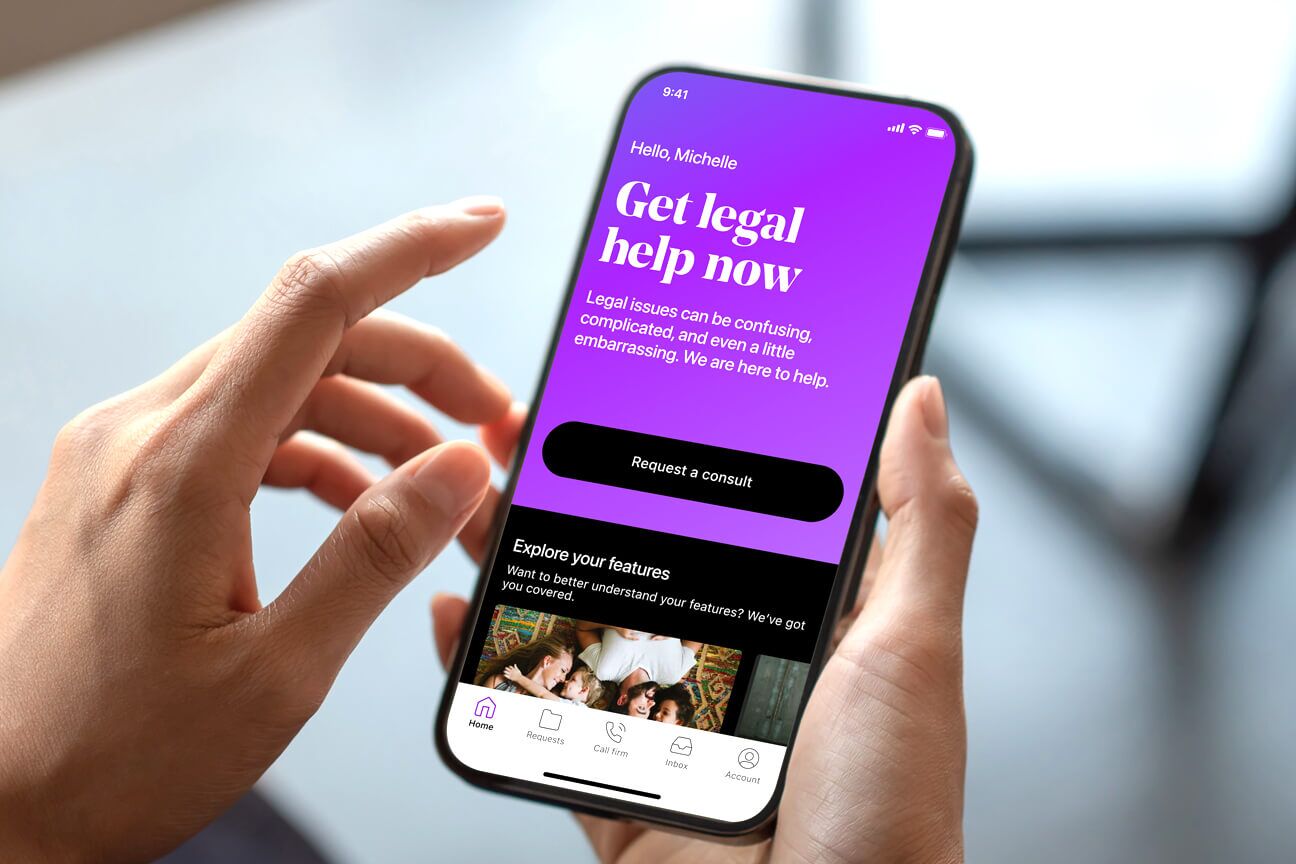

Finding solutions to your legal issues doesn’t have to be stressful, complicated or expensive. LegalShield puts the power of legal representation within reach of any individual, family, or business. We work hard to make it easy, simple, and affordable to get the legal help you need, when you need it.