The US housing market has been a wild ride for the last few years. If you’ve been keeping up with real estate market news, you know that it is difficult to make an accurate housing market forecast. But homeowners, buyers, sellers, landlords, brokers and more are all asking the same burning questions: “Is the real estate market going to crash? What are today’s real estate market trends?” People are trying to figure out how to get involved and stay ahead in the game.

We’ve gathered some of the crucial tips you need to know as you dive into the current real estate market. Grab your favorite beverage and pull up a chair—we’ve got you covered.

What’s the forecast for the 2023 housing market?

Housing news has been tumultuous for the last few years. During the COVID-19 pandemic, house prices plummeted and borrowing rates hit a record low, meaning that demand shot up and people hunted for homes left and right. Sellers were able to put a house on the market and wait for buyers to fight for the ability to buy that property.

In the last year, we saw prices soar back up, along with interest and mortgage rates. This led to a stall in the demand for homes since many buyers could no longer afford the costs. However, sellers were used to pandemic levels of demand and kept their prices high, waiting for buyers to make offers.

In the first half of 2023, the housing market has gradually begun to level back out. It is no longer skewed toward sellers having all the power. Meanwhile, buyers are searching for homes again due to rising salaries and slightly dropping home prices. This helps maintain balanced competition in the market.

Interest rates are still increasing, but buyers are willing to stay in the market for well-priced homes. However, these rising interest rates discourage lower-income buyers from shopping, as well as new construction from progressing. The market is more affordable for some people (due to salary increases) but less affordable for others (due to heavier interest and mortgage rates).

How does the housing market work?

How does the housing market work?

Let’s start very basic. The housing market is the total number of properties that are for sale at any given time. This market improves or declines based on local and national factors like social climate, geographic location, the state of the economy and more.

Buyers, sellers, landlords, renters, investors, and real estate agents are all interested in the housing market. It’s wise to examine national market trends before you start looking closer at the local or regional trends. This way, you can make more accurate real estate market predictions to get the best outcomes for your business ventures.

What influences the housing market?

As you try to make a forecast for real estate market in your area, consider these important factors:

Supply and demand

Supply and demand is the bread and butter of real estate. If supply is high and demand is low, sellers must lower prices to attract buyers. But when supply falls or demand goes up, sellers have more ability to charge more and be picky with their buyers.

Demographics

The housing market is heavily affected by demographics such as the age, race, gender, and income levels of the buyers in question. For example, if your college town is full of young people who recently graduated from university, this will impact the local housing market. The buyers are younger with less income and looking for places to live; demand is high, but sellers must consider their buyers’ demographics.

Geography

Where are you located? If your city is in a valley with limited space, this means there are fewer houses for sale. Sellers can raise prices because buyers don’t have as many options. But if you live in a sprawling town that keeps building and expanding, prices will drop.

Weather and season

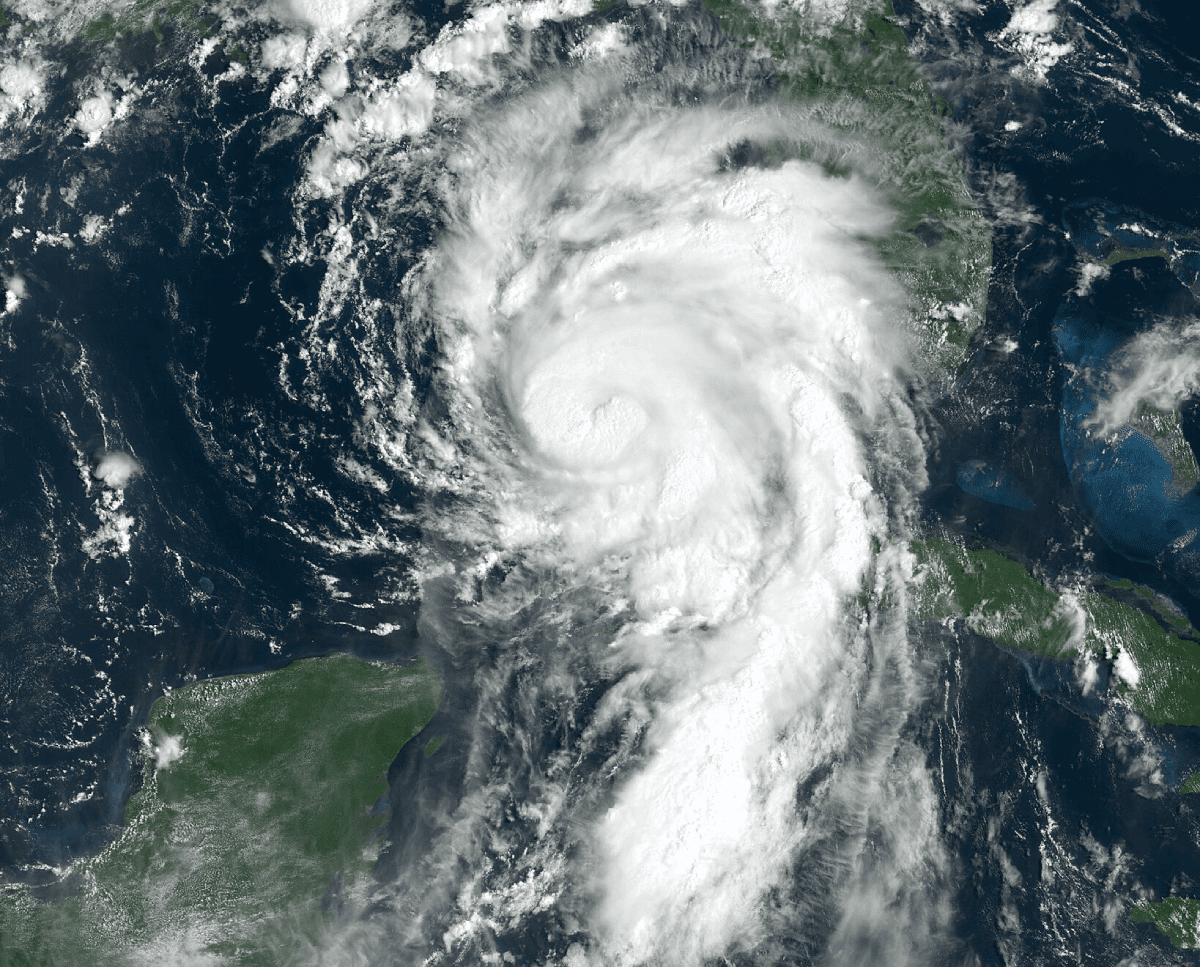

Weather and season

Similar to geography, weather and season can impact the market. If your area regularly deals with rough weather and natural disasters, sellers simply can’t charge as much because demand is lower. The season matters as well: House-hunting slows down in winter and speeds up in summer, meaning prices adjust due to the time of year.

Economy

How’s the unemployment level in your area? Also consider the tax laws, inflation, and other financial concerns in your state. These will all influence the local and regional housing market.

Will the housing market crash in 2023?

The real estate housing market 2023 is looking much better than it looked 10 years ago. Compared to the market during the pandemic, prices have dramatically increased and interest rates are much higher. But the drastic upward swing is leveling out this year. Real estate market predictions are generally optimistic. Experts agree that you most likely don’t need to fret about a market crash in 2023.

How to make money in real estate

Pros of investing in real estate

Investing in real estate always comes with a risk. But if you choose to get involved in the game, you can rest a bit easier with these benefits in mind:

- Investing in real estate gives you many opportunities for tax deductions.

- You have choices in how to invest—house flipping, REIT, rental home, etc.

- With a mortgage in place, you can use that to purchase other properties that are worth more. This is only possible when the property has equity.

- You get to sit on your investment for years as the price hopefully appreciates. Or you can rent the home and make regular income.

Ways to profit in the US housing market

Let’s dive into the various options you have for making money with real estate:

Real Estate Investment Trust (REIT)

Remember that REIT we mentioned earlier? A Real Estate Investment Trust gives you the opportunity to purchase property without having to do most of the work. You sell stock to another company or entity and let them use the property while you collect money from them. Apartment complexes, hospitals, and other big companies often engage in REIT deal with investors. Just make sure you know and trust the company you let onto your property!

Rental properties

As a landlord, you can make a good living from the rent your tenants pay you. You can also qualify for tax deductions because of business expenses. You will have to deal with tenants, make repairs or pay someone to do it for you, and take care of the financial side of the property. But when you prepare ahead of time and stay on top of things, the landlord life is a lucrative choice.

House flipping

Many people choose to purchase houses when the price is low, fix it up, and sell it when prices are higher. You’ll need some knowledge in home renovations and real estate trends, so do your research first.

Getting started in real estate with legal assistance

Even if you do your research and have all the real estate knowledge necessary to buy or sell your first property, you may not know the legal ramifications of your housing decisions until it’s too late. That’s why you should consult your LegalShield provider law firm before you jump in.

As a LegalShield Member, you have access to an affordable monthly legal plan that provides a broad range of legal services. Choose between a personal legal plan, family plan, or small business plan—we have options for your unique situation! And if you are a landlord, you can add the Home-Based Business Supplement to your personal plan to receive business assistance.

Get access to a provider law firm in your state. You can get consultation for an unlimited number of personal legal matters; get documents reviewed on an unlimited number of personal legal matters after consultation (starting at 15 pages or less each); and a phone call or letter can be provided on your behalf if the provider law firm determines it would be in your aid. LegalShield Members can receive a schedule of trial and pre-trial hours from the provider law firm as a named defendant in a civil action; you may receive 24/7 emergency phone consult on covered legal matters; and receive a discount to the standard hourly rate for personal legal services not provided by the contract.

Navigating the real estate market is no easy feat. Connect with your LegalShield provider law firm to access personal or business legal help!

Additional resources:

Pre-Paid Legal Services, Inc. (“PPLSI”) provides access to legal services offered by a network of provider law firms to PPLSI members through membership-based participation. Neither PPLSI nor its officers, employees or sales associates directly or indirectly provide legal services, representation, or advice. The information available in this blog is meant to provide general information and is not intended to provide legal advice, render an opinion, or provide any specific recommendations. The blog post is not a substitute for competent legal counsel from a licensed professional lawyer in the state or province where your legal issues exist, and the reader is strongly encouraged to seek legal counsel for your specific legal matter. Information contained in the blog may be provided by authors who could be a third-party paid contributor. All information by authors is accepted in good faith, however, PPLSI makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of such information.